file management

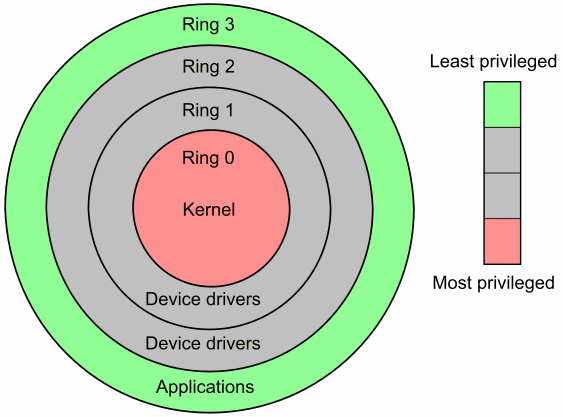

Don’t Pollute User Space

What is user space? User space is the location in the filesystem where users put their personal files – their “stuff.” Here’s the user space folder structure in the Windows XP operating system: Documents and SettingsUser Application Data Cookies Desktop Favorites Local Settings My Documents My Music My Pictures My